In the first month of 2021, the President of the Turkish Competition Authority (“Authority”), Birol Küle, made statements regarding the impact of Covid-19 on competition in Turkey. According Mr. Küle, there has been an increase in the number of investigations and an explosion in the number of complaints in relation to the health, hygiene and food sectors, especially concerning the pricing behaviour in these sectors. He stated that in 2020 the Authority imposed penalties for competition violations of TRL 2.4 billion (approximately EUR 285 million)—a seven-fold increase compared to the previous year.

In addition, in January Turkey’s Competition Board (“Board”) continued to apply the commitment mechanism for competition law violations introduced in 2020. In this regard, the Board accepted the commitments submitted by Türkiye Sigorta, Reasürans ve Emeklilik Şirketleri Birliği and OSEM Sertifikasyon A.Ş. and decided to conclude the investigations against them.

The WhatsAppocalypse: The Board launches in-depth investigation against Facebook and WhatsApp

As we wrote previously, the messaging and VoIP platform WhatsApp Inc., which is owned by Facebook, recently informed its users that WhatsApp’s terms of use and privacy policy is being updated, and that in order for users to continue using the WhatsApp platform they must consent by 8 February 2021 to WhatsApp sharing their personal data with Facebook companies or they will not be able to use WhatsApp’s services. As such, the update involves the collection, processing and use by Facebook of more personal data.

In its decision dated 11 January 2021, the Board initiated an ex officio investigation against Facebook Inc., Facebook Ireland Ltd., WhatsApp Inc. and WhatsApp LLC in order to determine if there has been a violation of the prohibition of abuse of dominant position regarding the obligation to share data imposed on WhatsApp users.

In its decision, the Board also stated that interim measures should be taken until a final decision is reached as a result of the investigation, as these practices have the potential to cause serious and irreparable damage.

In this context, the Authority informed Facebook to stop the conditions imposed to use WhatsApp users’ data for other services in Turkey from 8 February 2021 and to inform all users—those who had accepted these conditions and those who did not—that Facebook has stopped the new terms of data sharing by the respected date. You may find our detailed analyses here.

Ankara Uluslararası Kongre ve Fuar İşletmeciliği Merkezi A.Ş. (CONGRESIUM)

Based on a complaint submitted by Domino Fuarcılık A.Ş., in January the Board initiated a preliminary investigation against Ankara Uluslarası Kongre ve Fura İşletmeciliği Merkezi A.Ş. (“CONGRESIUM”) to determine whether it abused its dominant position on the market for trade fair area management through tying, excessive price discrimination and indirect refusal to supply.

The complainant, Domino Fuarcılık A.Ş., is the organiser of the international “Energy is Future” energy congress and expo, which takes place annually. CONGRESIUM provides the operation of the congress area to the complainant.

The Board first evaluated whether CONGRESIUM holds a dominant position in the market of field management suitable for organising international fairs and decided that CONGRESIUM is not in a dominant position, as its market share remained under 4% in 2016–2019. Nevertheless, the Board continued to evaluate the allegations regarding abuse of dominant position, as follows:

- Regarding the allegation of refusal to supply—the Board determined that the act of refusal to supply is based on the theory of exclusion of competitors by making their activities difficult, and that there is no competitive relationship between the complainant and the parties on whom the preliminary investigation has been conducted.

- Regarding the allegation of tying—the Board determined that the various services to be offered within the scope of fair organisation are necessary both contractually and within the framework of food health and human safety obligations. According to the Board, these applications are also commercially rational.

- Regarding the allegation of excessive pricing—various cost items of CONGRESIUM were examined and the unit price applied by CONGRESIUM to the complainant and the prices applied in similar fairs were compared. In this context, the Authority did not find any evidence to support the allegation of excessive pricing.

- Regarding the allegation of discrimination—the Board determined that there was no different or more disadvantageous treatment as claimed by the complainant, and even if so, fairs subject to different applications are not equal. Moreover, the Board ruled that the reasons of CONGRESIUM for the alleged practices were justified.

As a result, the Board rejected the complainant’s claims and did not initiate a full-fledged investigation.

The Board approved the following merger control filings in January at the Phase I stage:

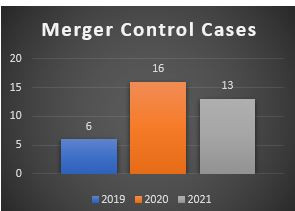

The Board approved 13 merger control filings in January—more than twice the number for the same period in 2019:

- Acquisition of joint control of Viking Holdings Ltd. by Viking Capital Limited, which is the current majority shareholder of Viking Holdings Ltd. with Canada Pension Plan Investment Board and TPG Capital;

- Acquisition of sole control of Flender Beteiligungen GmbH & Co. KG by The Carlyle Group Inc. via Zephyr German BidCo GmbH;

- Acquisition of joint control of Miller Insurance Services LLP by Cinven Strategic Financial Funds and Raffles Private Holdings Ltd.;

- Acquisition of joint control of Honshu Chemical Industry Co., Ltd. by Mitsui & Co., Ltd. and Mitsui Chemicals, Inc.;

- Acquisition of Innovera Bilişim Teknolojileri A.Ş. by FTA Bilişim Hizmetleri A.Ş. jointly controlled by Taxim Capital Partners I LP and Rahmi Faruk ECZACIBAŞI;

- Acquisition of sole control of Kümaş Manyezit Sanayi A.Ş. by Ereğli Demir ve Çelik Fabrikaları T.A.Ş.;

- Acquisition of sole control of Yaktaş İnşaat Sanayi ve Ticaret A.Ş. by Gerflor Mipolam GmbH;

- Acquisition of some shares of Zenit Madencilik Sanayi ve Ticaret A.Ş. by Özaltın İnşaat Ticaret ve Sanayi A.Ş.; acquisition of shares of Pontid Madencilik Sanayi ve Ticaret A.Ş. by Özaltın İnşaat Ticaret ve Sanayi A.Ş., Proje A inşaat Müh. Müt. Mim. Proje Dan. Tic. A.Ş. ve Galata Madencilik San. ve Tic. Ltd. Şti;

- Acquisition of sole control of Enerji Yatırım Holding A.Ş. by Ahlatcı Holding A.Ş.;

- Acquisition of sole control of Dürümle Gıda Sanayi ve Ticaret A.Ş. by Global Restaurant Investments III Sarl;

- Establishment of a joint venture between ElringKlinger AG and Plastic Omnium New Energies S.A.;

- Acquisition of sole control of Öztekfen Redüktör Motor Sanayi ve Ticaret A.Ş. by Saya Grup İç Dış Ticaret ve Sanayi A.Ş.;

- Establishment of a joint venture between TransnetBW GmbH and MHP Management -und IT-Beratung GmbH;

- In addition, in January Turkey’s Competition Board (“Board”) continued to apply the commitment mechanism for competition law violations introduced in 2020. In this regard, the Board accepted the commitments submitted by Türkiye Sigorta, Reasürans ve Emeklilik Şirketleri Birliği and OSEM Sertifikasyon A.Ş. and decided to conclude the investigations against them.

For more information please contact Bulut Girgin, Counsel, at bgirgin@gentemizerozer.com, and Ceren Ceyhan, Associate, at cceyhan@gentemizerozer.com.